941 Worksheet 1 Example

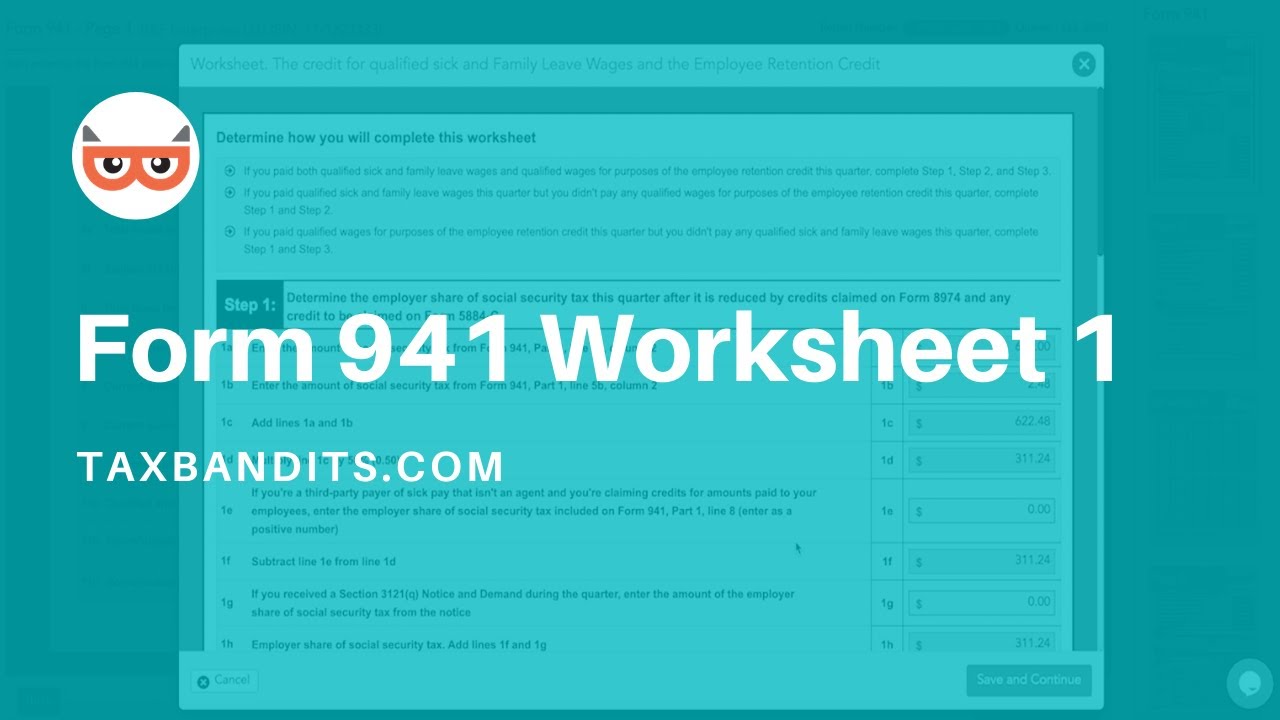

Based on the draft form 941 issued on april 30 2020 the employee retention credit erc will be calculated on the new worksheet 1 that will need to be attached to any 941 using payroll tax related credits.

941 worksheet 1 example. The irs released the draft version of form 941 in april with the covid 19 related changes and the final version was released in june. Click here to access a sample worksheet 1. Beginning with the second quarter 2020 form 941 the form has been updated to include worksheet 1 on page 5. Form 941 worksheet 1 for 2020.

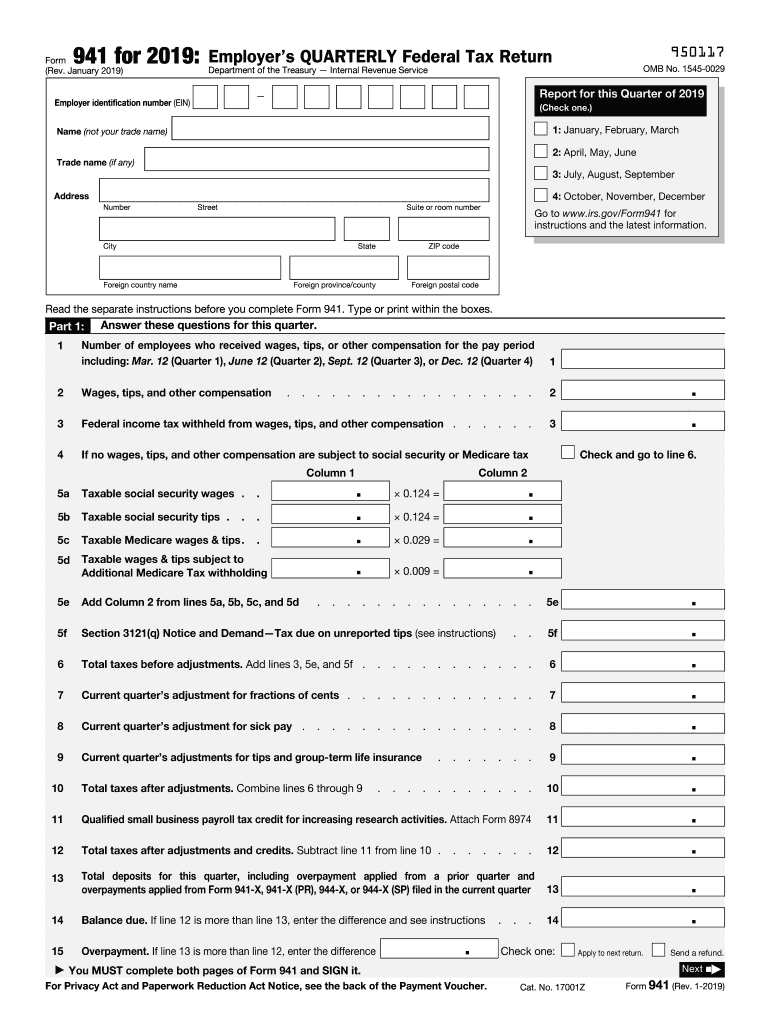

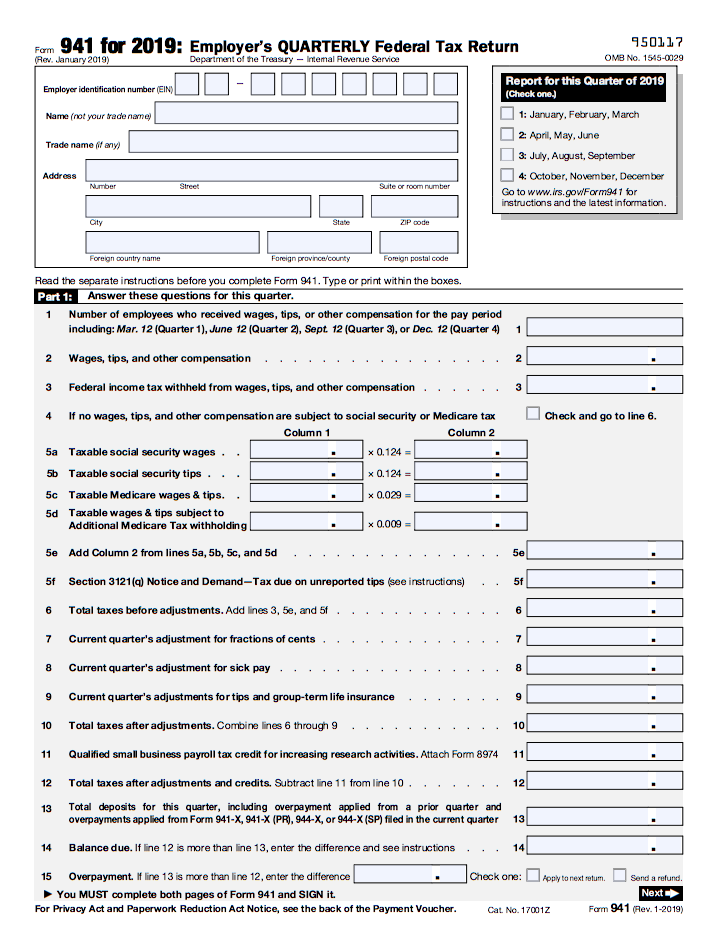

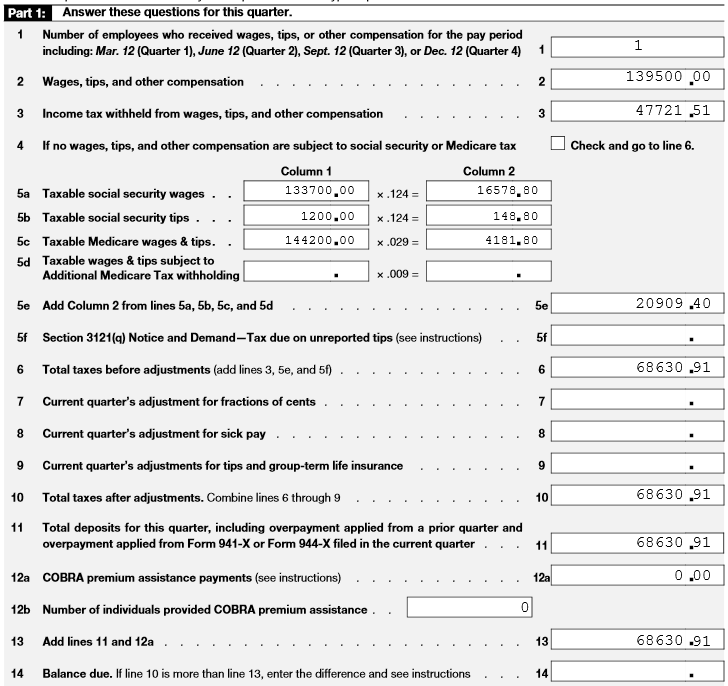

In the new form there is a new worksheet. Updated on october 15 2020 10 30 am by admin taxbandits. The 941 form mentions worksheet 1 and line items that will come from worksheet 1 but it s not included when filling out the 941. Column 2 is the amount from column 1 multiplied by 0 062.

Off to the right side mark which quarter the information is for. If you paid qualified sick leave family leave and have qualified wages for the employee retention program you will fill out all three parts of this worksheet. Form 941 has been revised to allow employers that defer the withholding and payment of the employee share of social security tax on wages paid on. I pulled worksheet 1 from the irs website and filled it out but the 941 won t let me override to fill in the appropriate line items.

July 2020 for coronavirus covid 19 related tax relief. The irs has released the new 941 payroll tax form for 2020. Employers who file form 941 employer s quarterly federal tax return must file the revised form with covid 19 changes from quarter 2. Fill out business information.

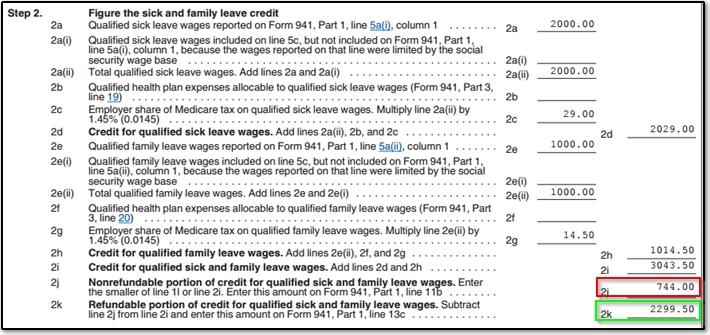

The july 2020 revision of form 941 will be used to report employment taxes beginning with the third quarter of 2020. However it is a great tool for completing form 941 for the second third and fourth quarters. Form 941 line 5a i pick up 180 for this payroll check and 20 will be included in worksheet 1 line 2a i. Both the sick and family leave credit and the employee retention credit have a nonrefundable and refundable portion.

This worksheet does not have to be attached to form 941. Join larry gray as he gives you guidance line by line. For example if the form is for the third quarter put an x in the box next to july august september. Changes to form 941 rev.

You will find this worksheet in the form 941 instructions. At the top portion of form 941 fill in your ein business name trade name if applicable and business address. Credit for sick and family leave wages and the employee retention credit. To help business owners calculate the tax credits they are eligible for the irs has created worksheet 1.

All you need to know about form 941 worksheet 1 2020.

%203.jpg)